By Baron Christopher Hanson

The outdated mantra “the customer is always right” has been challenged in recent years — and with good reason.

Unfair customers scream at airline, hospitality, and event personnel routinely. In a challenging economy, emotions at all kinds of “cash registers” can run high. Some customers cannot afford what they desperately want, or get to where they desperately need to be, quickly enough.

These restricted purse strings combined with shorter deadlines and increased stress –– often generated by reductions in staff and customer service resources — have led to greater frictions between patrons and proprietors.

In 2011, I wrote an article for Harvard Business Review on diagnosing workplace bullying among employees and bosses. That framework helped companies distinguish between hard-charging workaholics and deliberately sinister workplace bullies more fairly.

Conversely, this article is about sinister customers who cross the line and bully your business model. When their cash and time become desperate, some customers (clients, patrons, or members) can transact irrationally, even awfully. Perpetuating the problem, desperate companies make the classic error of “taking money from strangers” due to their own cash-flow challenges.

Like a shark, bully customers can smell a drop of blood in an ocean of water. Bullying customers are usually dishonest, uncivil, verbally abusive and do not pay well. Their tactics border on scam artistry.

Conversely, high-expectation customers want what they want — right now — exactly and perfectly every time. Although challenging, high-expectation customers are usually honest, civil and pay well for exceptional value or treatment.

In my view, honest, courteous and well-paying customers are always right. Deceitful, manipulative fiscally bullying customers are always wrong. Bending over backwards to serve the former while eliminating the latter is the thesis.

As a turnaround strategist, my firm advises business owners and C-suites experiencing expensive, painful and debilitative transactional bullying. We’ve turned around businesses in niches perceived as highly customized — architecture, advertising, interior design, sports-car restoration, event and wedding planning, etc.

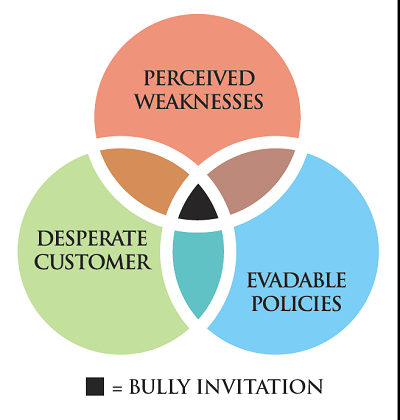

Hands-on client experiences from 2008 to 2013 allow me to conclude that the perceived weaknesses of a business, combined with desperate customers and evadable transaction policies, may actually entice bully customers.

Although each case was initiated and concluded differently, every client had been browbeaten psychologically and bullied fiscally by varying degrees of manipulative and deceitful customer patterns.

To be fair, gray area certainly exists between X) mutually healthy business negotiation and Y) unfair transactional bullying. An experienced architect in Michigan explains the disparity:

“Client bullying is a real problem for those of us in design roles. The intangible, lengthy creative process of architecture almost invites a bullying mindset. While good clients are appreciative, bully clients do not have a true budget, so they use their checkbook as a weapon. They attempt to weaken the value of our service by belittling our work and our people. The worst clients will deliberately waste your time, demand more options or changes, and then attempt to assign blame on you for their indecision, ultimately calculating strategies to delay or discount payments.”

Bottom line: The fiscal implications of bullying customers in today’s economy are reaching a tipping point.

A quick case study

From 2009 to 2011, a successful yet overwhelmed fine art dealer was experiencing new patterns of fiscal losses. Although a highly accomplished MFA curator, the business owner’s retail policies were too friendly and liberal. The stationery was beautiful, but the legal language and roster of transactional policies in writing were lackadaisical.

One bully client after another sensed the gallery’s transactional weaknesses and took unfair advantage. It was also discovered that a bully artist had somehow acquired the bulk of the gallery’s wall space, marketing budget, exhibition schedule and press — all while transacting with clients behind the dealer’s back. Expenses skyrocketed while revenues and profits tanked. The business was getting bullied from all sides.

Paraphrasing the helpful “E-Myth” series of books by Michael Gerber, “a stool with only two competent legs will not work.” The art dealer’s overall cash register strategy was assumed incomplete and unsustainable.

The art dealer finally conceded that her methods of transacting were collectively inviting trouble. So the probing process began. The gallery’s defenses were comprehensively overhauled. Starry-eyed interns were replaced with experienced professionals. Bully clients and artists were shown the door.

New transaction strategies and proficiencies were trained and installed. The company’s “cash register strategy” was overhauled psychologically, legally and financially. Eight months hence, gallery revenues have tripled. Profits have doubled. Debt is zero.

Solutions

Our work in risk mitigation has developed organically over two decades by combining forensic accounting analysis with on-site transactional mapping — more bluntly, playing good cop/bad cop inside client companies to thwart losses upfront. I often ask bullied clients (and their employees) to read the obscure Asian classic “Thick Face, Black Heart” by Chin-Ning Chu. She writes:

“Two people can read the same book on lion taming. They can enter the lion’s cage dressed identically. They can use identical gestures and words to command the lion. But the results may not be the same. One of them will get the lion to jump through the hoop. The other may end up a gruesome mess on the floor.”

To be clear, there is a difference between firing customers and queuing qualified prospects more carefully. The strategy is to prevent bad eggs from getting on the bus in the first place. One of my favorite examples of customer analysis and queuing management is El Al Airlines. Each passenger to and from Israel must endure hours of intense interviews and security checks prior to boarding.

The first step for a bullied business owner is to confront four transactional deficiencies:

- Poor prospect negotiation and customer queuing

- Lack of written transactional policies and guidelines upfront

- Weak or inexperienced front-line employees incapable of maintaining transactional boundaries (lion taming)

- Zero legal, accounting, or business strategy counsel in place

In my experience, chaotic, sloppy, unprofitable organizations routinely exude evidence of multiple transactional deficiencies simultaneously.

The second step is for bullied business owners to proactively implement a cash register strategy. If bullying customer regimes are common inside your business model, then your cash flows and HR culture are at risk fiscally. When a company stands up for itself as a team — from the C-suite through to each “cash register” location — bully customer regimes vaporize.

Baron Christopher Hanson is the principal and lead consultant of RedBaron Consulting in Charleston, S.C., and Washington, D.C. A former rugby player, Harvard graduate, and expert on workplace and transactional bullying, he can be reached via baron@redbaronUSA.com or via Twitter @RedBaronUSA.